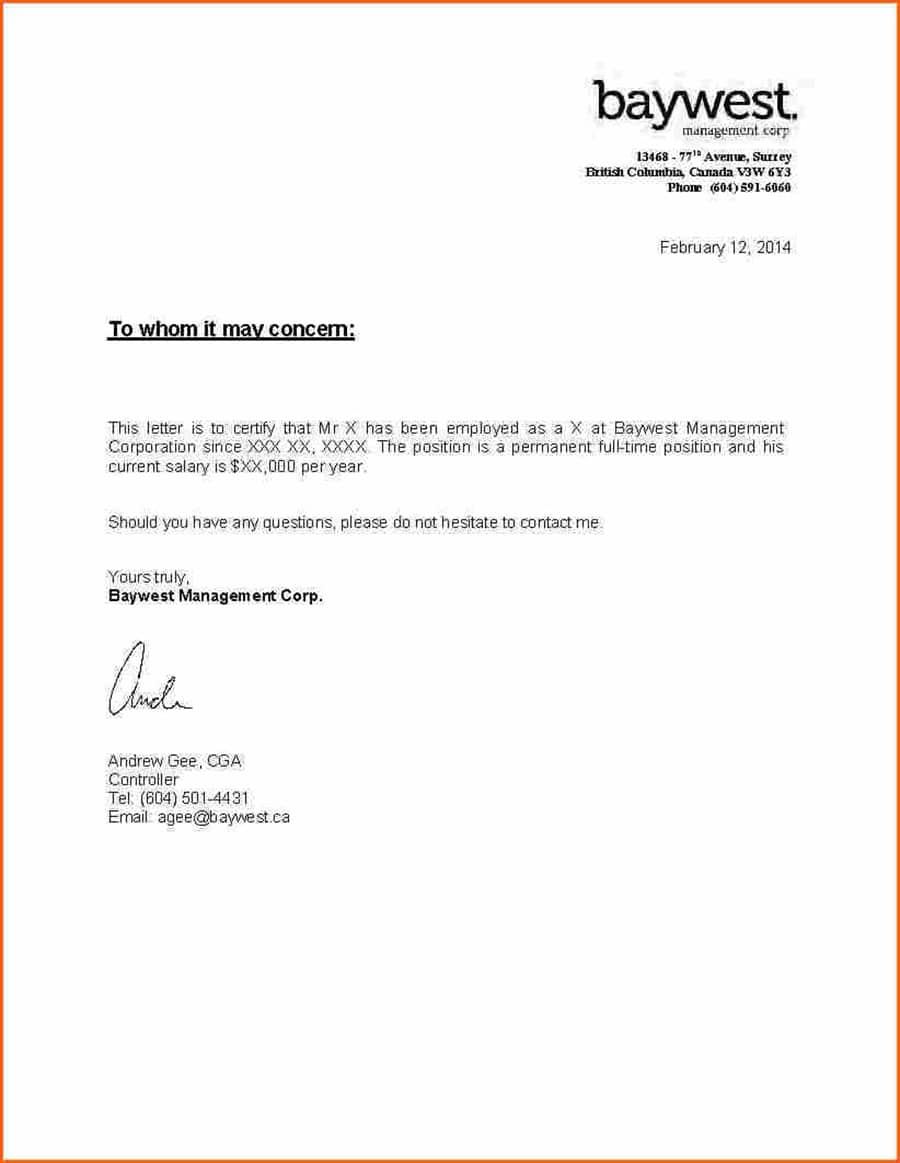

Employment Letter For Mortgage. How To Fill Out Employment Reference Letter For Mortgage with PDFSimpli in Five Steps? In a letter of explanation for your mortgage application, you may need A letter of explanation makes getting approved for a mortgage more cumbersome, but it's a positive sign.

Homebuyers want a fast, low-friction purchasing process — one where the lender doesn't ask for pay stubs or an employment verification letter to verify income and employment.

How To Fill Out Employment Reference Letter For Mortgage with PDFSimpli in Five Steps?

When you apply for a mortgage, underwriters will comb through your finances to determine if you're a good When You Apply for a Mortgage You'll Provide Employment Information. Employment Verification Letters are utilized by mortgage companies and banks when considering a mortgage or loan application, a loan With Rocket Lawyer, you can make an Employment Verification Letter for free in just a few minutes. Since employment verification letters often help employees secure mortgages, loans, apartments, new jobs and more, it's important to get your written communication right.